E

C

L

M

S

E

C

L

M

S

E

C

L

M

S

E

C

L

M

S

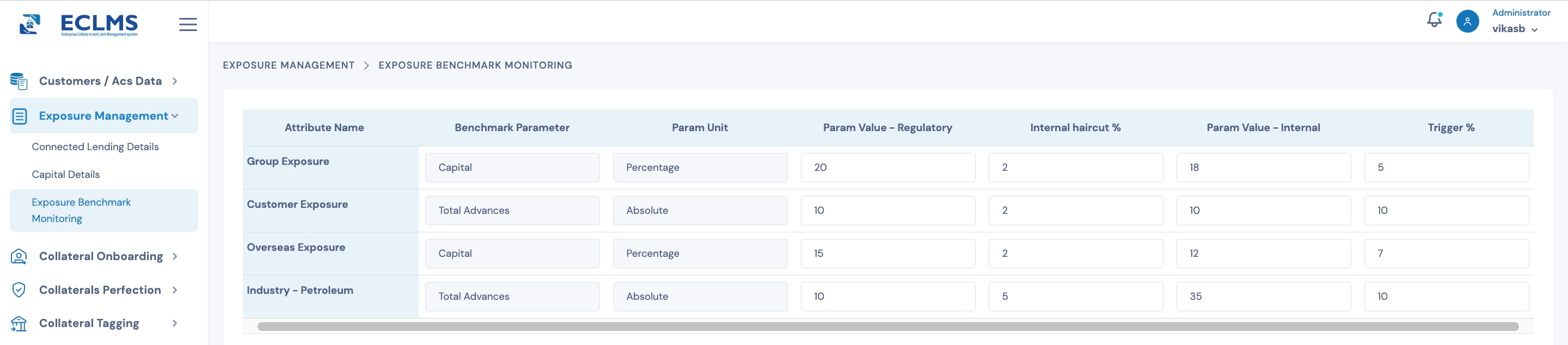

To avoid concentration risk Reserve Bank of India has stipulated multiple parameters like single group or customer exposure. Credit flow is also driven by regulatory guidelines to banks in terms of priority sector lending, lending to Agri sector etc. Bank also need to monitor expansion of credit portfolio against various internal parameters based on portfolio performance, profitability and pricing modelling.

ECLMS facilitates setting of benchmarks (regulatory & internal as well) using interactive interface. These benchmarks can be set against identified attributes like Capital/ Total Advances etc. Further, the system facilitates setting up of Regulatory & Internal trigger values so that well before breach of the benchmark, alerts are generated by the system to pre-warn the stakeholders for initiating corrective action.

Once, the parameters are set, the system automatically monitors the exposure against all parameters and notifications are issues to identified users as and when a particular is about to reach breach level. The system also monitors the minimum threshold values the client aspiring to achieve against a particular parameter supporting the optimal use of fund available at disposal.

This feature become even more important as a proactive feature when used while processing new loans. With given information, the system can pre-warn the stakeholders while taking up fresh exposure to a particular group, customer, segment, geography etc. The possibilities are limitless.